- The Ramp Report

- Posts

- Some Good News

Some Good News

A Few Reasons To Be Bullish

Hello friends, and welcome to The Ramp Report. If you want to join 10,000+ other readers learning about all things markets, tech, startups, business, and of course...memes, subscribe below:

You can also check out my other articles and follow me on Twitter too, but that's probably how you found this anyways.

Today's Post is Sponsored By:

Meet The Founder Behind The Robots With Unlimited Potential

CEO Mitch Tolson is pioneering the Golden Age of Robotics (and you have 3 days left to invest in his company, Ally).

While helping develop a $500 million food robotics titan, Mitch realized that robots were getting too complex and expensive for businesses to adopt.

That’s when Mitch took a deep dive into “imitation learning” - the idea that robots can learn by watching humans work.

The result?

A universal, no-code robotic arm that any business can implement and costs 70% less to produce than competing bots.

Next, they’re ready to help automate factories, airports, farms, construction sites, and anywhere else that needs a hand.

March 2020 was probably one of the scariest moments of my life. Covid-19 was spreading across the world and finally entered the United States. Businesses started shutting down, the entire country went into lockdown (15 days to slow the spread), and the market was in a complete free fall.

On top of that, my wife was pregnant with our 2nd child at the time so we were even more concerned about contracting the disease since no one knew what could happen to mom or baby.

Bad news was everywhere. It felt like the apocalypse. Then John Krasinski launched a YouTube series called Some Good News where he decided to break the cycle of doom and gloom by only reporting good news, a welcome addition in a world revolving around fear and dreadful news.

As the pandemic continued to drag out, the fear started subsiding, replaced by the urge to get on with living life. Just as 2022 seemed to be the year that we would finally get past the pandemic, the Ukraine/Russia war began, and the stubbornly high inflation started to take hold around the world.

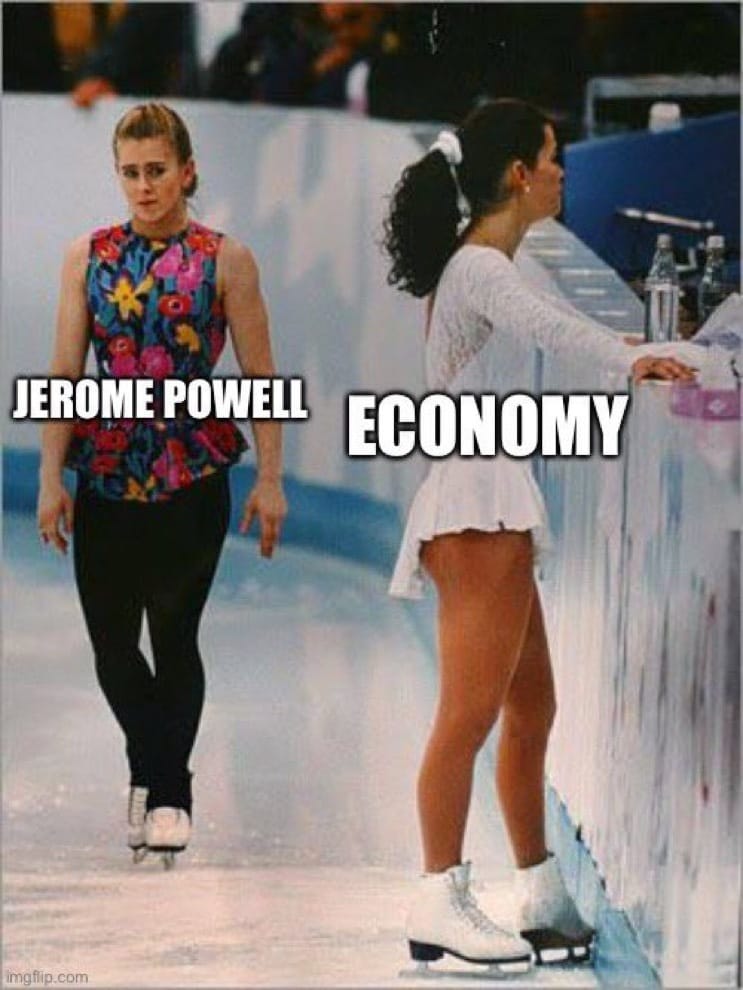

The Fed understanding they were behind the curve began aggressively raising interest rates to tamper down inflation. Since then the market has been a brutal drawdown across the board, with the major indices down anywhere from 19 to 30% YTD.

On Friday, the Dow Jones Industrial Average hit the same levels as it did in early 2020 before the pandemic. Two and a half years of gains evaporated.

There isn’t anything to be bullish about.

We need some good news.

Central banks around the globe are on a concerted effort to raise interest rates and bring down inflation.

Mortgage rates in the U.S. are already through 6%, more than double what they were 9 months ago.

Everyone’s concerned the Fed will push us into a recession if they don’t achieve a soft landing based on Jerome Powell's rhetoric this week. What is the Fed doing?

Again, there isn’t anything to be bullish about.

Until you ask.

Everyone knows bear markets are great for Twitter engagement. Higher the VIX, higher the clicks.

So of course I used this moment to leverage my audience to do the work for me.

Tell me something bullish. Anything.

— Capitulation Capital (@RampCapitalLLC)

12:48 PM • Sep 23, 2022

Over 850 comments (and still going). I read through every single one and distilled it down into some of the best ones. You can go through the rest of them with a glass of wine or your other favorite poison.

1) Expected Rate of Returns Are Increasing

Valuations and rate of returns are like a seesaw, when valuations start contracting, the future expected rate of return goes up, and vice versa.

The good news is for those who are in the beginning or middle stages of their investing careers and don't need the money right now, you're getting in at cheaper prices than you were in the past year.

2) Seasonality

I’m not a huge fan of seasonality but after seeing the chart below, wake me up when September ends. Ari Wald via Sam Ro: “Major market bottoms have occurred in October more than any other month.”

A couple more interesting charts posted by Mike Zaccardi show the seasonality trend heading into the midterms and pre-election cycle.

3) Record Put Volume

In the time everyone was running around like a chicken with their head cut off last week, Friday saw the highest put option volume in history at just shy of 34 million contracts. The market rarely rewards such one-sided trades, so a face-ripping rally could be in the works this week as too many investors get caught offside.

The last peak of put volume occurred in mid-June, when the market proceeded to rally almost 20%. While a short term rally could be inferred from this data, many are still expecting it to be a bear market rally instead of the absolute bottom. Most are still in the camp we won't bottom until we see inflation start receding, the Fed backing off or pivoting, or the geopolitical issues (WW3) start calming down.

4) Stardust

If you are all worried about the markets this morning just remember you are barely a speck of dust in this entropic universe and you will die soon enough and be forgotten in a blink.

— Pearl (@ppearlman)

1:26 PM • Sep 23, 2022

Phil Pearlman coming in hot with the existential crisis vibes, which actually reminded me of this bit from Pete Holmes.

When nothing makes sense and you can't control it, why even worry about it? Just live in the moment and learn from it. I'm already feeling better about our messed up situation.

5) Fed Pivot

Eventually, the Fed has to pivot. We're closer to the end of the tightening cycle than the beginning, in my opinion. This was displayed in the Fed's latest dot plot (which, by the way, means nothing because it’s a compilation of guesses from a small group of people who are always wrong).

The only real question left is if the Fed will achieve a soft landing. No one thinks so. If this ends up being the case and unemployment rate begins to spike, we may see inflation drop much faster and the Fed will then be expected to turn more accommodative and dovish.

This one is bittersweet. It's good news for peak inflation, bad news for folks who will end up losing their jobs.

6) Costco Bonus

A top Costco Wholesale executive confirmed the big-box retailer has no plans to change the price of its $1.50 hot dog-and-soda combo at its stores despite months of decades-high inflation.

Costco CFO Richard Galanti reiterated the cheap price point on the fan-favorite deal would stay in place during the company’s fourth-quarter earnings call on Thursday.

Worst case scenario, Costco will keep us fed through the tough times. No more Ramen. Welcome to Idiocracy.

Light At The End of the Tunnel

I'm not saying we should bury our heads in the sand and ignore the difficult times. I'm not going to tell you things are great. Things are downright terrible in many facets of the economy.

However, I do know we've always made it through to the other side and I don't see any reason why it would be different this time, even in the face of the most hawkish Fed we've seen since the Volcker era.

Difficult times breed innovation. Innovation breeds competition. Competition breeds success.

We just need some good news to turn the ship around.