- The Ramp Report

- Posts

- Murphy's Law

Murphy's Law

My Painful Experience Building A Home

Hello friends, and welcome to The Ramp Report. If you want to join 10,000+ other readers learning about all things markets, tech, startups, business, and of course...memes, subscribe below:

You can also check out my other articles and follow me on Twitter too, but that's probably how you found this anyways.

Today's Post is Sponsored By Composer:

Luck isn’t an investment strategy. If we learned anything from 2022, it's that investments don’t always go up. High-flying tech companies, cryptocurrencies, NFTs, and heck even bonds have taken a beating so far this year. Portfolios are hurting. But there is a better way to manage your portfolio than wishing for good luck. Investing with data and logic can help you weather the inevitable storms and grow your wealth year over year.

Enter Opus from Composer. Opus is quantitative investing done for you in a single, one-click portfolio. With Opus, you get a data-driven approach, dynamic rules that respond to market movements, and automated trading—in one strategy.

You can bury your head in the sand with a robo advisor, or you can power your portfolio with data. Discover why over $1 trillion is managed by quant funds with Composer today.*

*Investing in securities involves risks, including the risk of loss. Composer Technologies Inc., SEC Registered RIA. All charts and symbols are provided for illustrative purposes only and are not intended as recommendations to purchase or sell any security and do not reflect actual market conditions, stock performance, or AI decisions. This is a paid endorsement for Composer.

Murphy’s Law is usually attributed to Captain Edward Murphy, who served at Edwards Air Force base in 1949. As the story goes, Murphy complained about one of the technicians serving under him on a project studying the effects of deceleration on people: “If there is any way to do it wrong, he’ll find it.” The “wrong” here referred to wiring a transducer on a rocket sled.

Of course, the idea that “things fall apart” predates Murphy. Accidents, cynics, and entropy have been around longer than aviation. Similar expressions to Murphy’s law—”anything that can go wrong will go wrong”—appeared in an 1800s shipping journal and a 1908 article on stage magic.

But, the principle eventually became known as Murphy’s Law, a tongue-in-cheek riff on actual scientific laws like Kepler’s Laws or Newton’s Laws. Thankfully for the hapless technician, the law referred to the broader tendency of things to go sideways rather than to his incompetence specifically. So, at least one thing went right for him.

Buckle up. This is a long one.

If you were one of the poor souls who decided to build a house this year, you're likely experiencing the same pain I am, dealing with Murphy's Law on a daily basis.

Today's piece is about my personal story about my home building process that began in the fall of 2021. I'm writing this piece for a few reasons. It's been eating at my mental, physical, and financial health for 10+ months now. I'm hoping that getting my thoughts on paper will be somewhat cathartic and that some who may be in a similar situation can find solace in the fact that they're not alone. I'm also hoping that if someone reads this piece, they can apply some of the lessons learned in the future to their own build, if they are brave enough to take it on.

Backstory

We bought our first house in 2015, nearly 7 years ago. At the time, it was the biggest purchase we've ever made in our life and it was stressful to say the least. We knew this was just a "starter home" and was never meant to be our forever home.

After having 3 kids in this house, and saving a pretty substantial amount of money by living below our means for so long, we thought it was finally time to start looking for a new house. So in the fall of 2021, we began our journey.

It didn't take but a single weekend and a few open houses to realize that the housing market had gone completely crazy. I remember going into a few homes that were listed anywhere from 50-75% more than our current estimated home price, thinking those houses were in worse shape than ours. Really the only advantages were they were bigger and in better neighborhoods and school districts compared to our current home.

Then we started touring a few more homes on the higher end of our range to see what we could get for our money. We ended up liking a lot of things about one home in particular, but didn't pull the trigger to at least throw a bid on it. It turned out they got over 20 bids, with I'm assuming most went over asking price.

This seemed to be happening over and over from that point on. Or we would see a home, message our realtor to schedule a tour as soon as possible, only to be disappointed hours later with a message back saying there was an all cash buyer waiving all inspections and contingencies. Very cool.

Based on the price range and the conditions of the homes we had looked at, our realtor suggested considering a new build. With the thought being that we would be in a similar price point to some of these higher priced existing homes, but all of our stuff would be brand new, less prone to replacement, and we could pick out all of the finishings to get exactly what we wanted. Sounds great.

We toured a few new developments. The homes were beautiful. The only real knock from my viewpoint was that it was a suburbia hellscape in some of the subdivisions we had looked at. None of the trees were mature so literally all you could see in every direction were hundreds (maybe thousands) of homes. We hated that.

Then we found a subdivision that was supposedly one of the more popular ones in the area with some very nice custom homes built on it. It was also in a good school district and we heard great things from friends who lived near the area.

After meeting with the realtor who represented the developer, and then meeting with the home builder, we started seriously considering the possibility of a new build. We sort of kicked the can down the road for a month or two as we kept our ear to the ground on the new development. We just weren't sure if maybe we jumped the gun on this incredibly hot housing market and should try to wait for it to cool off.

Then we received some unexpected news that we were pregnant with our third child, oops. Our hand was essentially forced at this point. The day we found out, we verbally agreed with each other that we were going to build the new house. We knew that our starter home wasn't big enough to fully support our growing family. Could we have made it work? Absolutely, but we were running up on the 7-10 year estimate that we said we would live in our starter home. Moreover, we both worked hard for the upgrade after saving and investing diligently for many years.

Before we went under contract we had multiple sit down meetings with the builder to go over how the process would work and also to add items to the build that we knew we wanted, in hopes of coming to a relatively firm estimate. This is why I get annoyed when people say "expect to go 10-15% over budget". While that may be the rule of thumb for new builds, we discussed all of those things before going under contract, to minimize the surprises down the road.

For example, adding in costs for the backyard fence and finishing out a portion of the basement for an office. So we added that to our contract then put down a six figure deposit in earnest money that was essentially non-refundable unless we find an out from a unique or unprecedented circumstance (defined by who and what exactly?).

Rates

There are folks out there who started building a house when mortgage rates were 2.5% and are going to be at 8% by the time the house finishes

— Austen Allred (@Austen)

7:17 PM • Oct 9, 2022

Right around the time we started looking for homes, I was also talking with a local mortgage broker to discuss what we could afford at current rates. I remember going back and looking at the rates I got from her. They were all in the low 3's for a 30 year fixed rate.

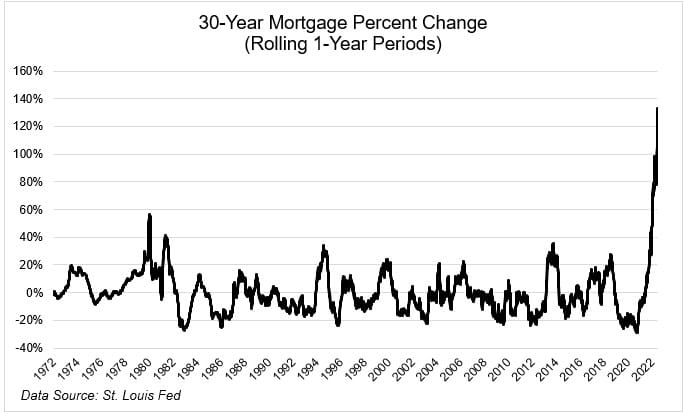

I also remember around that time, discussing with her what my options were for locking in a rate on the new build. I had known around November of 2021 that inflation was starting to accelerate and Powell had essentially said they were going to start raising rates. So I went back and looked at some charts of mortgage rates over the years and said "ok, let's just run a few prices at a 5% mortgage rate". You know, as a worst case scenario. Well, mortgage rates hit 5% in the first four months after we went under contract on the new-build.

As of this writing, the 30 year fixed (per Freddie Mac) is sitting at 6.66% (devil), up from 3.22% at the start of the year. I still have not locked in a rate on the new build. We don't even have a firm closing date on the house yet. It could be mid to late January at this point. Pain.

I didn't expect rates to go from all-time lows to 20-year highs in 10 months. But here we are. If you refinanced at some point between the start of the pandemic and the start of 2022, you essentially won the lottery. However, you're also now likely to remain in your current home longer than anticipated (with higher rates and prices) unless you become a forced seller for whatever reason.

This has probably been one of the most stressful parts of the home build process, watching rates go parabolic every single week as the Fed tries to rein in inflation. Especially because had we purchased a house outright in late 2021 or early 2022 we would have locked in a very low rate. Now this has forced us to look into other alternatives such as adjustable rate mortgages (ARMs).

I had never really considered an ARM, mostly because I think they got a bad rap in the 2006-2008 housing bubble when underqualified borrowers lured in by the initially low interest rates were unable to keep up payments when they rose. Maybe it's different this time? Where do things start to really break in the housing market? 8%? Are we in uncharted territory?

My thoughts are if we truly believe the Fed, and their own dot plot projections (they're never right), that the federal funds rate will be <5% into 2025 and beyond, that they can actually bring down inflation substantially, or if they do cool off the labor market enough to cause a material recession, all of these scenarios should cause interest rates to drop. Thus, hopefully allowing a chance to refinance into a fixed product within the initial fixed rate portion of the ARM. However, a meaningful recession could also cause material weakness in housing prices as well. A conundrum indeed.

All of this being said, I'm still going to run amortization schedules on fixed products vs ARMs and understand all of the risks associated before getting into one. The timing is interesting as we are seeing the ARM meltdown play out in real time over in the UK, where millions of homeowners are about to get hit with ballooning mortgage payments.

Inflation

When we went under contract and reviewed it in detail, we had asked our builder about the escalation clause listed in the contract. The builder mentioned in more than 20 years building houses they had never had to enact the clause, until the prior year. But now that supply chains seemed to be getting better and the end of the pandemic was on the horizon, there didn't seem to be any cause for concern at the time.

Then Russia decided to invade Ukraine and everything that seemed to be getting better started falling apart again, at home and around the world.

Three to four months into the build, it was nearing time for framing and purchasing of the lumber. I had been hawking lumber futures daily, hoping to get some reprieve from the parabolic move. And by the time we were getting ready to start framing I had noticed lumber futures were down roughly 30-35% from the peak and back down to levels before we went under contract.

That week I was getting ready to write an email to the builder and ask if we would be getting a deduct on our build because lumber prices were starting to retreat. Before I could send the email, I had already gotten one from the builder saying they were enacting the escalation clause in our contract and charging us +$50k more for building materials (lumber, etc).

We were in complete shock. Not only did our home price go up significantly, it also had put us in a spot of potentially backing out of the build. The problem was, the builder said if we backed out now, they would keep our deposit until the home sold, which was still 9+ months out. Our contract wasn't very forgiving but we also didn't get lawyers involved beforehand or during this process.

We had also discussed delaying the build to see if material prices would come down (they eventually did months later), but we would have had to pay the contractor's carrying costs. The builder ultimately recommended against this decision, and us not knowing any better, deferred to them.

We are planning to have a meeting with the builder again in a week or two to discuss the path forward and what else they can do for us. It seems as if we are the only assholes still building and moving forward and that they are just trying to stick it to us on every turn. I'm not saying that's the truth of the matter, it just feels that way. We are the suckers.

Price Transparency

The biggest takeaway from this build process so far is the lack of price transparency. Maybe it's because we don't hold the construction loan. Maybe this is how it always is. This was my main concern before we went under contract. I told them I wanted to walk through everything that we wanted for the house and build in allowances to cover these.

The problem is when we met with their vendors to select the items, we didn't see the bill until after selections were made. Basically, we would meet with the vendor, they would ask us what we liked, we would pick things, then they would come back to us with pricing. It was extremely confusing because it felt like there was never a reference point to what our budget even was. Even worse yet, we carried some of the builder-grade standard finishes in our contract that we explicitly said we did not want and wanted to upgrade.

The only industry I could compare it to is the U.S. healthcare system. Where else do you go into a process and pick out things you want/like and are not given prices upfront? Moreover, because the builder has the vendors selected for us, we only had one option for everything. This made it incredibly difficult to price shop or compare. It's not like you can just google a certain light fixture and say "hey, that same one is $300 cheaper on Amazon" and they will just give you $300 back.

We were forced to go through their vendors, and most of them were pretty incompetent. I had caught multiple mistakes through backsplashes, lighting layouts, cabinetry, countertops, you name it. I caught thousands of dollars worth of mistakes.

It's also interesting how we slowly become numb to price changes throughout the build. After living in our current house for 7 years, we probably only put $20-25k into the house to upgrade certain things, with most of it being done by myself. Now I laugh when I look back and think about how much of a tight ass I was to not pay $300 to hire someone to help fix our bathtub or pay $1,500 to put in a new dishwasher, etc. Money has lost all meaning because of this build. It doesn't feel real.

What to Expect

During the post-framing walkthrough, we were getting ready to finish up when I pulled the construction manager aside and told him this was the most stressful thing I've ever done in my life, including dealing with three kids. I told him if someone were to ask me about how the build was going I would tell them to never do it, ever. He appreciated my candor, or at least that's what he said at the time.

I understand my experience is unique and "unprecedented" (I'm so fucking tired of this word), but there are still things in here you can learn from. If you are someone who is very meticulous with details, it will literally drive you crazy. If you're rich enough to not give a shit, you'll probably just continue to throw money at the problems until they go away or get fixed.

So what should you expect if you are going to build a home?

Expect delays, expect headaches, expect to pay more than what you thought you would, expect things to be wrong, expect everything. If you can at least go into the build thinking it will be very difficult, you may be pleasantly surprised if it turns out to be a breeze because you're anchored to the pessimistic viewpoint.

Murphy's Law

For the call back to Murphy's Law, here's what has gone wrong on our home build (so far):

Labor rates through the roof.

Material rates through the roof.

Supply chain issues (causing delays in the home build).

Ballooning site costs (because they didn't know what was under the soil until they started digging)

Mortgage rates went from <3% to ~7% in 10 months (which impacts our new home and will likely impact the sale price of our existing home come January 2023).

Building a house during 40 year high inflation and looming recession.

Our construction manager was moved to a different subdivision in the middle of a build.

I caught multiple mistakes by multiple vendors overcharging me thousands of dollars in materials because they are incompetent.

Being nickled and dimed constantly as they aren't able to hit our budget or "that wasn't included".

Essentially zero price transparency on the selections.

Lesson’s Learned

Every builder in every market will surely be different. Make sure you review your contract with a lawyer and understand your potential outs in case the market or other forces start turning against you. If you can, build in provisions into your contract for these outs. This may also force the builder to make certain concessions if the market turns against both of you.

Prepare for the worst. What happens if I go $100k over budget? What happens if interest rates go from 3 to 10%? Will I still be able to afford it? Will I be put in an uncomfortable or unattainable position? It’s not to say either of these will happen but they could and it’s better to acknowledge the possibility beforehand than be surprised right before closing.

Look into different type of loan options. Maybe you can get a 6-month lock that could help get you in a cheaper mortgage. Or maybe you could carry the construction loan. Talk to local banks. There are likely better options out there. Discuss them with your builder and mortgage lender before you go under contract.

Price transparency. Ask for receipts on everything. Ask for drawings on everything. Review everything. Question everything. They are working for you. They are building your dream house. Expect nothing less than perfection. Or just ignore everything and save your sanity.

We're still not entirely sure if we're going to see this through until the end. There are still risks out there. We don't have a mortgage rate locked, we don't know if it'll appraise into a vastly cooling housing market. We don't know what will happen to the price of our existing home that will be used for our new house down payment.

To use a Texas Hold 'Em analogy, it feels like we're pot committed. We have a decent hand (nice house) and paid a ton of money to see the flop (down payment) and the turn (vendor selections) but there are some potentially better hands out there that can beat us (not appraising, more inflation, mortgage rate lock). The question is do we call the market's, the Fed's, and everyone else's bluff and pay for the river in hopes of winning it all?

What's the worse that could happen now seeing that everything that could possibly go wrong already has? That's Murphy's Law.

Of course the market crashes the day I buy a house

— Vamp Capital 🩸 (@RampCapitalLLC)

9:00 PM • Jan 5, 2022

If you've dealt with a similar situation or have any advice, I'd love to hear your story.